How Jay First Got Involved in Construction:

If you ask our Construction Supervisor, Jay, he’ll describe his exposure to construction throughout his youth as “generic,” noting that he would help his Dad or Grandfather build a shed, do deck repairs, or other things along those lines.

As time marched on, Jay “was confronted by a couple different opportunities to get into the business, and that kind of turned into a little bit more high-end trim carpentry, cabinetry, built-ins, libraries, things along those lines.” He defines his journey as kind of going backwards. “I started from the fine stuff and moved back into framing and things of the like instead of the natural progression where you would typically start on a framing type of issue or drywall hanging issue and progress into some of the finer stuff.” Jay’s experience in high end construction came during his time in New York and New Jersey. He mainly worked in the city in New York, so obviously there wasn’t a lot of room for ground-up construction. “There’s no grass, to be blunt,” he explains, “so we focused more on fit-out jobs – both high-end residential and commercial work.”

He spent quite a few years doing this work in the second to none hustle and bustle that is working in Midtown “before redeveloping, re-upping, and moving into the agriculture end with my company, GreatGrow, which brought us out here to Pennsylvania.”

GreatGrow, which develops soil and plant amendments that increase crop yields, improve soil structure, relieve soil compaction, improve soil oxygen, and promotes the use of water while suppressing foliage and root disease, has since turned into an Intellectual Properties firm, as Jay has been “basically selling his inventions off and things along those lines.”

Jay found himself back in construction – only on the other side of the table – as a Building Code Official and Zoning Officer for Kraft Code Services for six years. “From there, it felt like the natural progression was to move away from that and get back into what I spent so many years doing in New York on the construction side of things,” says Jay.

Jay Meets D&B:

Jay describes himself as a learner and a thinker. Although he had an element of sitework experience in the past, it wasn’t quite to the scale of the multi-family projects that he is leading with D&B Construction. “I like learning new things, so moving into the sitework and infrastructure work and these big parts of the multi-family is very eye-opening and exciting,” he explains.

“I’ve only been with the company for a bit over a year, and I have my hands in a bunch of stuff. I think just with as many moving parts that we have throughout all the different projects, that challenge to keep up with the Joneses and to make everything happen and keep everybody happy that’s pretty much what fuels the fire within me. You wake up and hit the ground running 100 miles an hour all day long.”

Jay Outside of D&B:

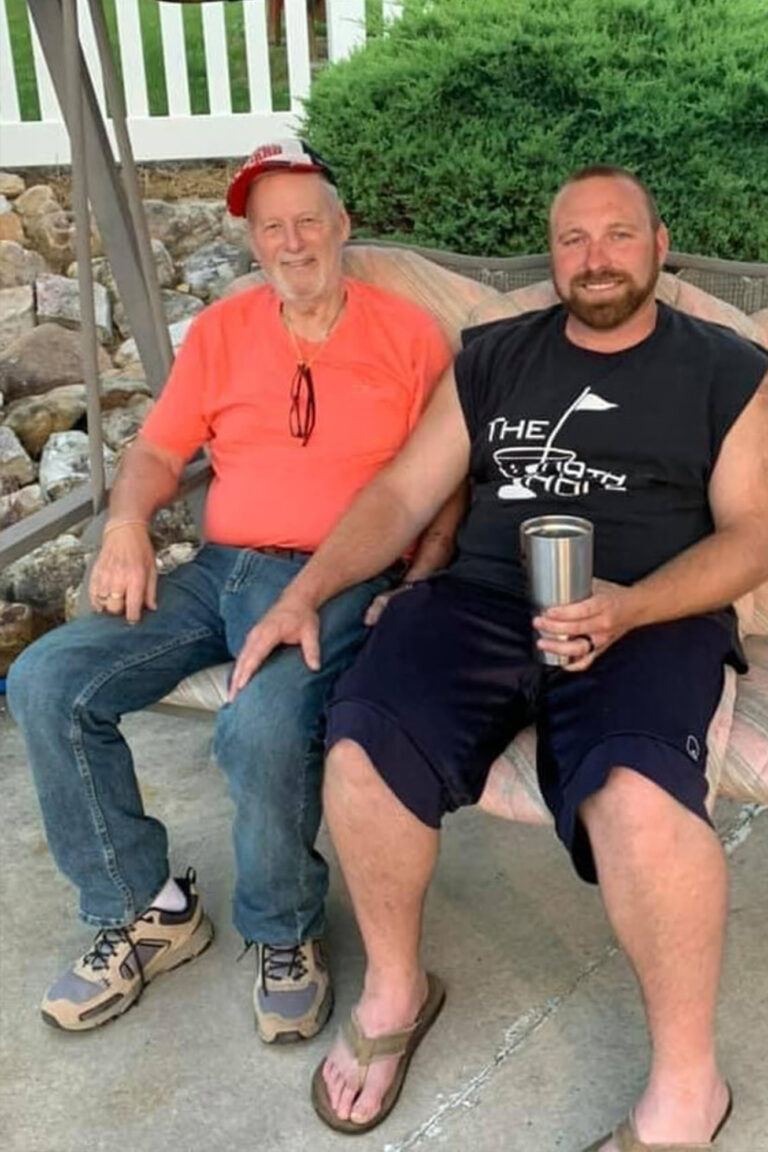

His main motivation that gets him out of bed in the morning? His family, of course, which he describes as “the most important part of my existence as a whole.” Jay and his wife have two children: Madeline and McLaen. Although his son is getting ready to go away to college soon and his daughter is about to enter high school – thus making things a lot less busy than when they were much younger – the Holmgren family is still very active.

Madeline is described by her father as a “brilliant dancer,” and McLaen, who played a lot of soccer growing up, has since transitioned over to music in his late teen years – following in his Dad’s footsteps. “He’s picked up a lot of my instruments that I held. Once COVID hit, and I told them they weren’t going to be on their screens 24 hours a day, he started running with it. He’s actually moving more towards playing the bass than the guitar like I did. That love for music has definitely been passed down there. He’s quite the guitarist, quite the bassist,” Jay says with a proud smile. A younger Jay used to write poetry and lyrics, and his son is also following in his footsteps in that regard, too, having put his first couple little pieces together, which Jay describes as “well thought out and well done.”

He describes his daughter, Madeline, as the same with her dance and her art – she draws a lot and things along those lines (just as Jay used to sketch and sculpt a bit).

“I like to think that a lot of the artistic stuff that I did when I was younger was passed down to the youngins,” he explains. Obviously – school’s always important. Jay’s wife, Suzanne, helps the kids with homework as much as possible. “It’s a day to day. You know – we’re just a family,” explains Jay, “but it makes it all worthwhile when you come home to a house full of issues – or not – to keep a smile on your face.”

Finding An Extended Family in D&B:

“I think D&B’s support structure overall is – not to throw the word / term ‘team’ around, but there is such a team structure to D&B. I’ve worked in companies and represented companies in the past where they were very fragmented. Everybody kind of worked on their own keel, not a whole lot of cross over. I do really feel at D&B you have solid relationships. If you need somebody to talk to about this, that or the other, there are people here that are genuinely interested and really nice shoulders to lean on here and there. I try to provide the same, but you know it’s definitely a family feel, a lot of support structure. If people need things, we’re there for each other.”

Often times, we are asked “What’s your why?!” Why do you do what you do? What motivates you to get out of bed each morning? What is your calling?

Our Senior Superintendent, Mr. Ruza’s calling was always construction. His dad was a builder, so he got into construction at just 10 years old. This instilled Mr. Ruza’s unparalleled work ethic at a very young age. Growing up, he traded in his summers and weekends at the shore to help out his Dad on the jobsite.

He joined the Local 845 Carpenter’s Union to complete his apprenticeship, and he also attended college for two years to study Architectural Engineering. Mr. Ruza worked as a Carpenter until he left for the Marines to serve in Vietnam. After serving his four years, he soon started working again, and he has been doing it ever since. If you ask Mr. Ruza about his career he’ll give you this simple – yet definite – answer: “It’s in my blood. That’s all I really know how to do.”

Something else you should know about Mr. Ruza? He just might be the definition of grit. He loves a challenge, stating that he’ll “never turn down a challenge when it comes to work.” With a smile, he concludes: “The harder it is, the better I like it.”

Another aspect of his calling just may be his commitment to safety. It’s no secret that safety is a huge component of construction day in and day out, but Mr. Ruza goes the extra mile, embodying the D&B way of safety being our standard. In 2013, he worked for a General Contractor that was working for a University in Philadelphia. They had just finished constructing a restaurant that was supposed to open at 5:00, but next thing they knew something broke and they were trying to fix it. There was a hole in the wall that was not properly covered. Mr. Ruza walked across it, fell, and shattered about three inches above his ankle. He spent about 30 days in the hospital and 18 months learning how to walk again. “I always took safety seriously, but after that I really got into it. I’ve been doing it since 2013 as a Health and Safety Officer for different companies. That’s why I’m here as a Senior Superintendent for D&B. My job is to enforce OSHA regulations and safety,” he explains.

As an active member of D&B’s Safety Committee, Mr. Ruza has an OSHA manual on the desk in his job trailer. Here, it does anything but sit and collect dust. He is actively reading it from cover to cover to stay up to date with any changes, and he isn’t afraid to pull someone off his jobsite if they are violating any safety regulations. “I liked working with my hands. Now I’m getting well-seasoned, so now I use my brain and my knowledge. I try to teach anyone that wants to be taught,” he says.

For Mr. Ruza it’s all about work and one other important thing – family. After his accident on the jobsite in 2013 he wasn’t sure if he would ever be able to work again. While that in itself was difficult for him, the hardest part of that time in his life was not being able to do things with his two young children.

Today all of his children are grown. His son just bought a house to fix up and rent out, so he’s been going over to help him with that. Otherwise, he lives a simple life. “I leave my job site. I go home, eat, and watch TV. I go to bed early because I get up early. That’s about it. I don’t really take vacations or anything. It’s all about work,” he explains. Mr. Ruza takes so much pride in his work that he has even spent Holiday weekends giving his family a tour of his jobsite. That’s passion for the job.

Labor shortages is a hot topic right now. In the construction industry alone, there are approximately 400,000 job openings. Currently, 67% of construction companies are experiencing skilled labor shortages across the globe. Couple this with an increase in material cost (we’re talking nearly quadruple the cost of plywood wholesale prices from $400 to $1500 per thousand square feet that we saw during the first year of COVID-19) and you have a minor reason to panic.

According to our Chief Operating Officer, Brennan Reichenbach, the cost of construction has doubled – and in some cases nearly tripled – in the last approximate five years alone. The substantially cheaper costs of a fit out vs. ground up construction are all the more reason for a developer to consider adaptive reuse projects over new construction – especially in the current climate.

As the icing on the cake, mix these two factors together with the dwindling amount of available development space in metropolitan areas, the current housing market and the nation’s housing shortage, and you get the perfect recipe for a high demand in multi-family housing. Despite all of the stressors currently weighing on the millions of people who touch the construction industry in some capacity, when looking at the current climate through the eyes of a developer, it may just be the perfect cocktail for opportunity. Read on to find out how:

The Housing Inventory Issue Coupled with Available Development Space:

Inventory of houses is an issue across the nation right now. It’s no secret that the prices of reselling a home is at an all-time high, and that is due in part to the fact that new construction is expensive thanks to all the hurdles that need to be jumped in order to reach the finish line of complete construction. A rather stubborn supply chain has been no help in driving down the cost of housing either.

Berks County has been a Seller’s Market since September of 2021, with homes in the county selling for 10.3% more than they would have a year ago. The number of homes for sale in Berks County this year is the highest it has been in the last 15 years. For comparison, in May of this year there were 759 homes on the market throughout the county compared to just 530 the month before. This is an increase of 43.2%.

Gallup’s annual Economy and Personal Finance Poll, conducted in April and published in early May, revealed that 69% of respondents believed it is a bad time to buy a house. This is the first time that a majority of Americans have felt this way in the poll’s 44-year history. The factors likely contributing to this majority statement include rising interest rates and the inability for new housing construction to have a significant impact on the demand for housing.

A recent interview on Keller Williams Realtor Brad Weisman’s podcast Real Estate and You featured Kevin Timochenko, Founder and Owner of Metropolitan Companies, who handles development, building, and management. D&B is currently building a number of multi-family apartments (like The Reserve at Iroquois) for the company, who is also scheduled to build between 200 and 300 single-family homes from Pittsburgh to Delaware within the next year.

Timochenko discusses how developing in Berks County is a different story than the other areas his company typically deals with. Although land is available, it is harder for developers such as Kevin Timochenko to make money on this investment since land and improvement costs are so high in this area, thus making it difficult to build. The amount of preserved land in the area also can complicate things – especially when land is being preserved in the middle of commercial corridors that would better serve the community if developed. To add insult to injury, Berks County is one of the most preserved counties throughout the state of Pennsylvania with over 75,000 acres of preserved farmland.

If you trade the farmland of more rural areas for the concrete of larger cities, you’ll still find the same overarching issue of a lack of available square footage for new development – just in a different setting.

So How Do All These Negatives Make A Positive?

The solution may just be repurposing the commercial square footage already available. Currently, society as a whole is seeing more and more real estate developers buying office buildings so they can convert them to residential use. A recent high-profile example was announced in Washington D.C. with plans to convert two older office buildings – Universal North and Universal South – near DuPont Circle on Connecticut Avenue. The buildings, which total 700,000+ square feet, marks Philadelphia-based real estate firm, Post Brothers, debut into the metro Washington D.C. area.

The firm may be onto something, as they found success in redeveloping a former warehouse in Northern Philadelphia into The Poplar, which includes 285 apartments and high-end amenities including a world-class fitness sanctuary rooftop dog parks, and three infinity-edge saltwater pools.

Time will tell how this transition fares, but it looks like many metropolitan areas throughout the country – with our nation’s capital as the main experiment – will be serving as case studies for converting former commercial space into residential housing or even mixed-use development. In an article in the Washingtonian, Senior Editor Marisa M. Kashino was told by John Falcicchio, Washington D.C.’s Deputy Mayor for Planning and Development, that adaptive reuse is needed to “save downtown.” In the metro D.C. area alone, approximately 325,000 units need to be added before the end of the decade in order to keep up with the demand. Many have their eyes on the recently estimated 157.9 million square feet of rentable office space in the D.C. area as a potential solution for this issue.

The Push for Office-to-Residential Conversions

Many other metropolitan areas aside from Washington D.C. are seeing a strong push for adaptive reuse projects focused on converting office space to residential multi-family living – so much so that legislators are even passing laws to assist with this trend. The latest budget for California included a call to action to spend $400 million “as an incentive to developers to convert commercial and office buildings into affordable housing in the budget years 2022-23 and 2023-24.” In early June New York Governor Kathy Hochul signed a bill that made it easier to convert underused hotels into permanent housing. Just last week, city officials in Chicago announced that they would provide tens of millions of dollars to developers willing to convert aging office towers into residential buildings.

New York City’s push for such conversions is also apparent with the $1.5 billion transformation of the former home of Irving Trust Bank at One Wall Street in lower Manhattan, marking itself as the largest office-to-residential conversion in the city’s history. Take a detour west to Salt Lake City, and you’ll find Houston-based developer Hines, an international real estate firm, acquired a 24-story office building – South Temple Tower – which they plan to convert into a 255-unit luxury apartment complex starting in early 2023. Similar projects are also in the works in major cities such as Atlanta and Dallas.

A Look At The Local Forecast

Given the strong trend of these conversions in larger cities, it is inevitably just a matter of time before we see this start to take hold in more sub-suburban areas.

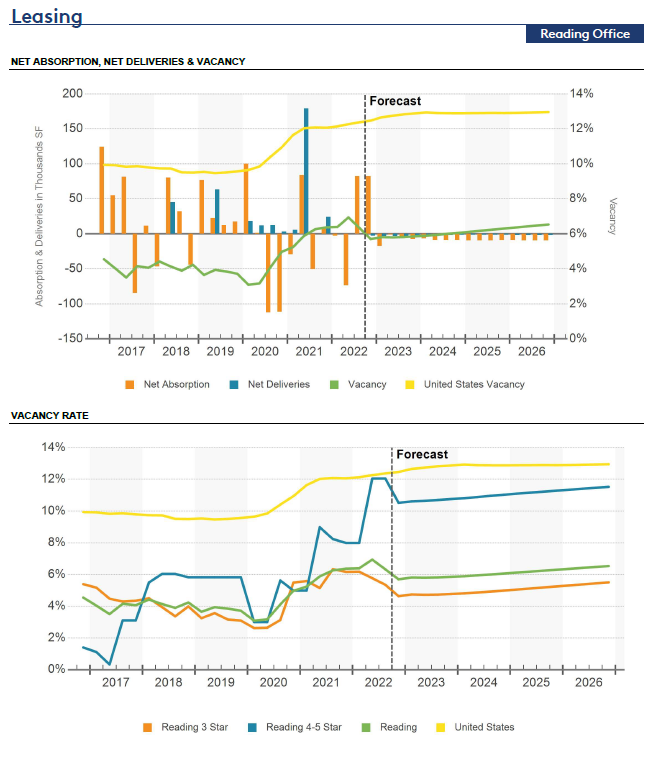

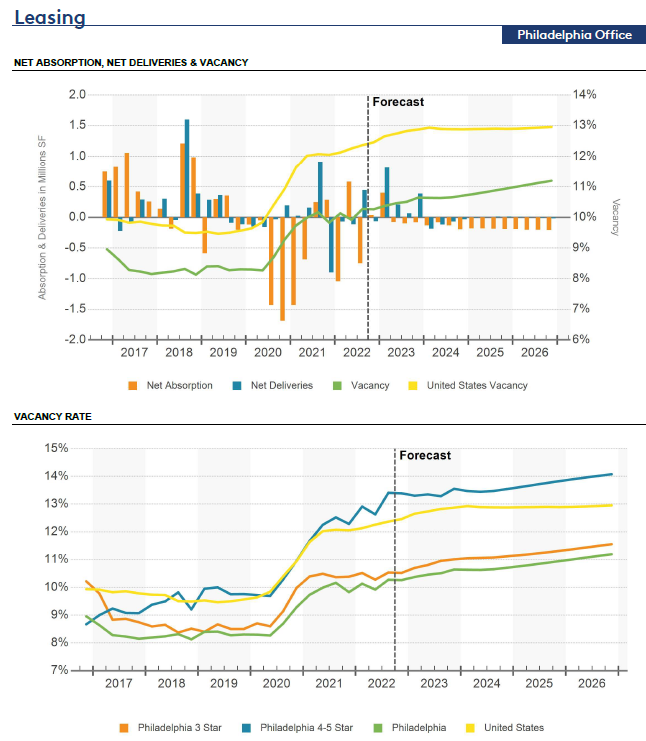

Patrick Zerbe, Commercial Real Estate Agent for NAI Keystone, has been watching this trend start to take hold since the pandemic. “The pandemic fast-tracked transitions in different trends. The largest transition we are seeing in the commercial real estate world are businesses providing remote and hybrid work. With less people in the office, companies and organizations have determined to decrease their footprint, which in contrast has given an influx of vacant office space. We have primarily seen this in larger cities, but this trend is slowly making its way to subsidiary markets,” he explains.

Recent data from Co-Star, a global leader in commercial real estate intel, provides a good example of what Patrick discusses. Reading, PA has a 6.3% vacancy rate for the nearly 13.5 million square feet of office space available in the city. In comparison, of the 323 million square feet of office space in Philadelphia, 10.3% (or 33 million square feet) is currently vacant. This is an increase from the historical average of 9.5%.

“A lot of companies no longer want to worry about sharing common space, and more people want direct access and direct walk-in space to their offices. A multi-story office building in the center of a city hosts a lot of common areas,” he reflects.

As a commercial real-estate agent, Patrick sees many redevelopment opportunities in the multi-family market. “With the prices of land and material, building anything ground-up is incredibly expensive right now. Any chance a developer may have to look at a re-development project to substitute some of these costs is a winning combination,” he states.

Aside from the obvious solution of breathing new life into corporate complexes as an adaptive reuse project, Patrick predicts that large retail centers and institutions such as old schools may be a great opportunity for development into multi-family housing to aid the housing crisis.

Let us know what areas you think would serve as the perfect adaptive reuse project for multi-family living in the comments below!

World Architecture Day was established by the International Union of Architects (UIA). Architecture is something we consume every day, as it creates the physical environment we live in. It impacts our society and makes up the culture of every community across the globe.

Meet some of the Architectural firms that we are fortunate to regularly partner with here at D&B Construction:

About Meister-Cox Architects:

Meister-Cox Architects provides exceptional customer service. Clients are provided with all services expected from a large firm with the close client contact of a small firm. They like to help with the difficult projects and will take on the projects that other firms may not.

How has Meister-Cox Architects grown and evolved since being founded in 1974?

The firm was founded by Bill Meister, one Architect, one Drafter, and a Secretary who worked on small commercial projects, elderly housing and multi-family projects. They have steadily grown over the years, with four architects, one designer, and an office operations manager as of 2022. Hospitality projects, industrial projects, and larger commercial projects have enhanced their portfolio. Since 2019, the firm has gone back to their roots by adding several multi-family housing projects to their experience. Their client base is built largely through repeat business, and most of their work is received through referrals.

What type of projects does Meister-Cox tend to specialize in?

Multi-Family Housing, Hospitality, Industrial / Commercial, Places of Worship, Township Buildings, and Daycares.

On average, the firm completes this many projects in a year:

79

Out of all the projects Meister-Cox has completed together as a firm, they are collectively most proud of the following:

They are most proud of their partnership on the design of Dekalb Pike and Virginia Drive. These projects were a natural extension of their hospitality and multi-family experience and have allowed them to expand their portfolio in new and exciting directions. Through these projects they were able to express a contemporary architectural vernacular style and have challenged their team to create affordable, beautiful communities in which to live. Meister-Cox is thankful to be part of the team that will bring them to fruition, and they look forward to many more years of a successful partnership with D&B Construction.

Some other projects Meister-Cox is teaming up with D&B on include active construction on Wyomissing Square and multi-family projects currently in pre-construction, such as Milford Ponds and The Lofts at Fort Washington. Lastly, it’s always worth mentioning this awesome office and showroom they completed for Kountry Kraft Custom Cabinetry.

About Olsen Design Group Architects:

Olsen Design Group Architects is a firm of qualified and experienced professionals who are committed to excellence and who understand the importance of each individual client. Their office location allows them to comfortably serve the geographical area of southeastern Pennsylvania and the northeastern United States. It also gives them the ability to be available for an impromptu meeting or site visit to resolve a situation as quickly as possible in order to best serve their clients. Quality and thoughtful aesthetics, attention to detail, and “service after the sale” are what they stand by.

How has Olsen Design Group Architects grown and evolved since being founded in 1993?

As they approach their 29th year as a firm, they have lived through 2.5 recessions, the pandemic and a reorganization. They have ‘fine-tuned’ their project methodology to be client-involved from day one. Today they have five full time team members and three “on call” team members as needed.

What type of projects does Olsen Design Group tend to specialize in?

Healthcare (hospital based, clinical based, behavioral health and addiction treatment / rehab specialization), Multi-family residential housing, Commercial / Retail and private homes.

On average, the firm completes this many projects in a year:

20-25

Out of all the projects Olsen Design Group has completed together as a firm, they are collectively most proud of the following:

Healthcare. Regardless of the size or the complexity of their healthcare projects, it is most rewarding to assist our clients in planning / designing and building facilities to care for people of all ethnic origins, stations in life, and of all ages to help them live quality lives and improve their conditions.

One such noteworthy healthcare project that Olsen Design Group worked with D&B on was the Penn State Health – St. Joseph renovation in Muhlenberg Township. Here’s a view of the exterior and interior of the building:

A medical office fit out for Quest Diagnostics is another healthcare project currently under construction with this architect firm. We’re also huge fans of this well decorated medical office fit out that Team D&B worked with Olsen Design Group for Molly Hottenstein Orthodontics.

An array of multi-family residential complexes in multiple locations throughout southeastern Pennsylvania also complete Olsen’s portfolio with D&B, including projects locally that are currently under active construction – such as The Reserve at Iroquois, and The Reserve at River’s Edge in Enola, Pennsylvania.

About RHJ Associates, P.C.

RHJ Associates, P.C. is a full-service architecture, planning, and design firm with offices in Philadelphia, King of Prussia, and Wilmington, D.E. Established in 1977, they provide comprehensive design services in the commercial, institutional, and private markets. Their continued success correlates directly to the pride they take in their emphasis on communicating, learning, and implementing best practices. This is reflected in the fact that over 95% of their work is from repeat and referral business.

What type of projects does RHJ Associates, P.C. tend to specialize in?

RHJ maintains a diverse portfolio of projects including: medical offices, corporate interiors, senior and assisted living facilities, educational facilities, automotive dealerships, car wash facilities, retail and shopping centers, restaurants, fire houses, fitness centers, and private residences.

D&B Construction has had the pleasure of working with RHJ on many projects near and dear to our heart, from the large adaptive reuse project taking place in Wyomissing, PA to make way for Stratix Systems’ future headquarters and our own new headquarters, which was completed in February of 2022.

About Meyer Design Inc.:

Meyer Design Inc. was founded by George Wilson within Meyer Design, Meyer Architects is a Certified Minority Business Enterprise and an award-winning architecture firm that has been recognized across the country for innovative design and contemporary solutions. In 1987 Meyer Architects was launched with a promise to design places of enduring value – 35 years later our passionate architects continue that tradition. We are industry leaders in developing innovative, technology-based solutions that solve complex construction problems and push the boundaries of architecture and design.

What type of projects does Meyer tend to specialize in?

Commercial Architecture, Workplace, Senior Living, Active Adult and Multi-family, Life Science, and Healthcare.

D&B Construction has had the pleasure of working with RHJ on a variety of healthcare projects for well-known clients like Tower Health’s new outpatient office in Womelsdorf, PA and CHOP’s ambulatory medical office in Souderton, PA. We’ve also enjoyed working with Meyer on workplace projects like an 11,200 SF medical office for Griswold Home Care.

About Architectural Concepts, P.C.:

Architectural Concepts, P.C.’s ability to maintain a balance among artistic, technical, and business disciplines embodies their holistic approach to architecture and interior design. Architectural Concepts is result-oriented with a strong proficiency in creative innovation and technical execution, allowing flexibility in accommodating the needs of their clients.

Their philosophy of client involvement and personalized service is why Architectural Concepts has grown continually since its founding in 1976. Their approach is to form a partnership with their client. A significant amount of their work is a result of long-term relationships and referrals. This team approach ensures that the client has an essential, meaningful impact on the design process from concept to completion.

Their mission is to conduct the activities of the firm within the highest ethical standards of the profession; strive to develop a long-term association with their clients by respecting their needs and implementing effective solutions to strengthen this partnership; and contribute to the community to maintain an atmosphere that encourages learning, exploring, and the true enjoyment of architecture.

What type of projects does Architectural Concepts P.C. tend to specialize in?

Architectural design, interior design, space planning, furniture design and selection, artwork coordination, site analysis and design, structural engineering, and more for the Corporate, Education, Civic, Athletic / Sports, Hospitality, Multi-Family, Single Family, and Worship sectors.

D&B Construction is currently working with the firm on two multi-family projects, including Village Greens Apartments and Butler Square Apartments for our client, Berger Rental Communities, who we also completed Willowbrook Clubhouse for with this firm.

Alex is a Construction Manager with a 16-year record of success overseeing all phases of large multimillion-dollar construction projects. In addition to completing many multi-family communities for D&B Construction, this includes various other commercial projects, infrastructure, and upscale residential communities.

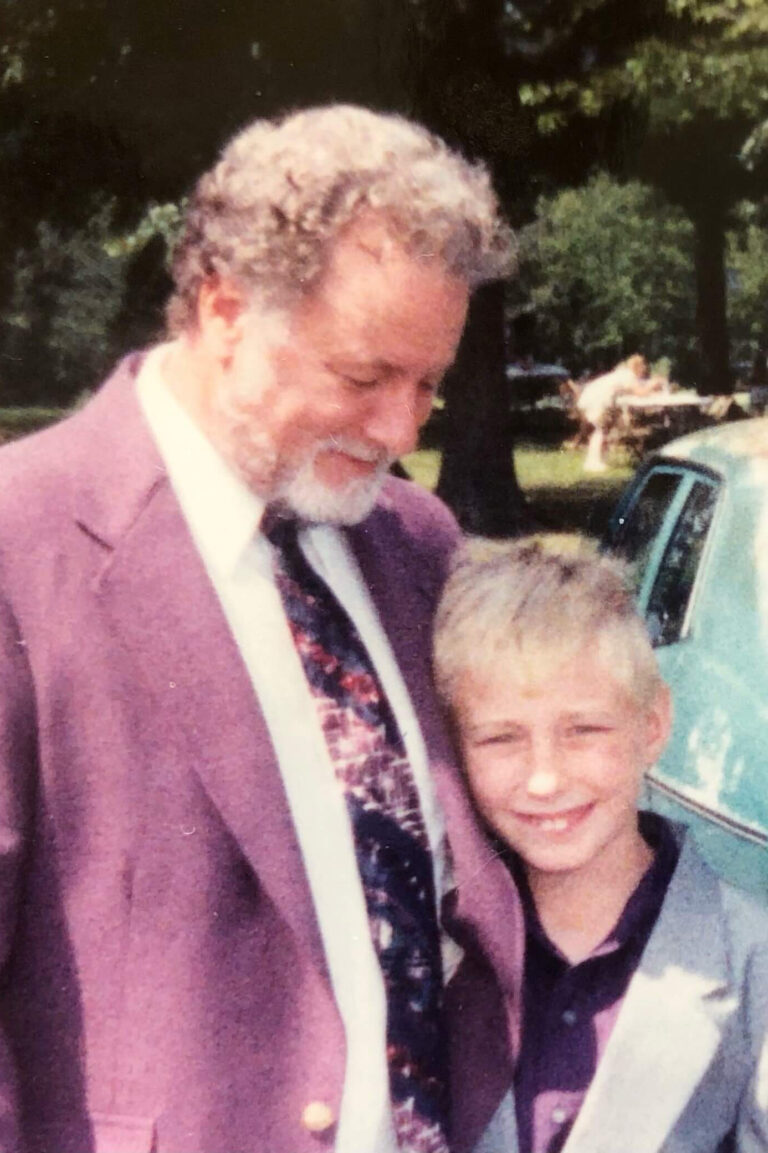

Backed by strong credentials and a proven history of high-quality project completions, Alex’s success exceling in his work of managing large multi-family construction projects was a result of his Grandpap pushing him to “go on to bigger and brighter things.” Alex’s experience in the industry started at the young age of six years old. His grandparents owned a construction company, and after school he would always want to be dropped off with his Grandpap on the job site. He loved the action of construction.

Alex continued gaining hands-on experience until he graduated from high school. It was then that his Grandpap encouraged him to go to college. Although Alex wanted to take over his construction company, his Grandpap envisioned the bigger and brighter plans that he is currently fulfilling at D&B.

Alex obtained his Construction Management degree from Penn College. After graduating, he worked for both Ryan Homes and NVHomes building single family and first-time home buyer houses. He was recognized with over 10 awards during his time at NVHomes, one of the top home builders in the nation. “Once I got to that stage it really kind of brought it full circle. I got to interact with so many different homebuyer people and meet them before we even broke ground. Throughout the process we developed a relationship with these guys, and it was so cool to take their dream and turn it into a reality,” explains a grateful Alex with a smile.

His passion for being part of the process of taking “ideas on a napkin” and making it come to life is evident in the smile that crosses his face when he describes why he does what he does for a living. Alex says there is no better feeling than watching this process take place and seeing an idea transition from engineering and architecture to buying ground and taking it vertical.

Alex continues to pass along the lessons and work ethic that Dave, his Grandpap, instilled in him from a young age through his own two sons – Cameron and Liam. They both had great time getting a tour of what a day at work is like for their dad – safely with their PPE and all!

If you ask Alex’s wife, Michelle, she’ll tell you how much their sons love helping Alex out with projects around the house. “They always ask to help us, and if they’re not helping they are definitely watching and learning,” explains Michelle. “They’ve used their old gator to help take an old deck down, helped install floors, and they ‘renovated’ the club house attached to their swing set by adding a door, a table, and a pulley system to carry things up and down in a 5-gallon bucket with some help from Alex.”

Michelle could definitely see them following in Alex’s footsteps, just as he did his Grandfather. “Cameron is always building something with his magnet tiles, and Liam always pretend plays by setting up construction sites with his toy trucks and toy tools and acting as the Project Manager,” she says with a smile.

When asked if she thinks Alex still would have worked in the industry had his Grandpap not owned his own construction company, her initial response was no. However, she elaborated to explain that she thinks he still would have done something with his hands – be it a mechanic like his Dad or working in the family’s logging company. “I think he would still have that passion and dedication for great customer service in any career he chose,” she explains.

“Alex is on time, if not early, with deadlines. He’s responsive and takes time to explain the building process. I have seen his passion and dedication to his customers continue over the years. We have met many people and made many new friends through his work. I think the fact that people who he’s worked with in the past still keep in touch with him speaks volumes about the passion and dedication Alex has. He just really cares about people and giving them a quality product,” she concludes.

This is why Alex is a great fit for the D&B culture. He has the “We Care” mentality that we call the D&B difference.